Digitalisation and AI : Driving the change in smart waste management: what were the top trends in 2022?

Digital Deposit Return systems get installed in more and more countries.

- © SensoneoAs the world population continues to grow, so is the need for better waste management. Smart solutions and digitization are redefining the way waste is processed, bringing a positive impact on costs, sustainability, and efficiency.

Being present in over 80 countries, Sensoneo has been on the mission to drive the development of the smart waste market and shape the future of waste management. The year 2022 saw ever greater demand for waste optimization, connected to increasing waste management costs, new regulations, but also growing environmental consciousness. Such trends are reflected in this year’s company activities, which include complex sensor deployments in Argentina, Saudi Arabia, or Norway, as well as the launch of deposit return schemes in Slovakia and Malta

What were the top trends shaping the smart waste industry in 2022?

1. Increasing prices for collection and treatment of waste

Inflation, rising cost of labour and increasing prices of energy and fuel are only one part of the reason why cost of waste collection and processing is going up. Waste industry is a very regulated one, with the trend being in closing landfills and pushing for better recycling, while also adding new materials such as biowaste or textile. Bigger complexity inevitably means higher prices.

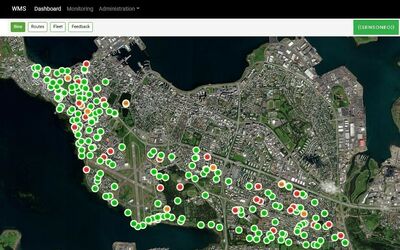

The costs can be cut significantly with a waste monitoring system, which optimises waste collection routes and frequencies, resulting in route reduction by at least 30 %. In 2022 Sensoneo partnered with Urbetrack on a large sensor deployment in Buenos Aires, Argentina. The company is using their own software platform which collects data from Sensoneo sensors located in 2000 bins. As Pablo Ader, CEO of Ubertrack explains: “Right now the data from waste monitoring is used to understand how the bins are operated and for optimization of bins placement - whether some apartment blocks need less or more bins. That is the first stage. As we are collecting very valuable data about bin fullness, the city plans to use them when concluding a new contract for waste collection. With such data it is possible to switch from fixed collection frequency to a dynamic one, optimising collection routes and collecting only the bins that are full.”

Buenos Aires is the first city in the region to deploy bin sensors on such a large scale. According to Pablo Ader, “Technology has not yet deeply penetrated the waste industry in Latin America. We want to set an example for other cities and countries, as we already see from the data gathered that there is a less expensive and more efficient approach to waste collection. Currently we are expanding the monitoring into more bins, deploying additional 2 500 sensors.”

Other complex waste monitoring projects were launched in Island, Serbia, Cyprus or Spain. While some municipalities monitor all their bins, others opt only for those in distant locations, underground bins, or bins in busy locations which are frequently overfilled.

2. Incentivizing citizens to create less waste and recycle

There is a call for fairer fees for citizens, motivating people to create less general waste and pay only for the waste they produce. The municipalities or housing associations are exploring several options. One is smart bin access management, allowing access only to authorised people. This can be paired with a pay-as-you-throw model or volume-based fees. Installing smart locks helped Slovak town Dubnica, which had issues with so-called waste tourism. According to Janka Beniakova, head of the town’s environment department, “After deploying semi-underground bins everyone started bringing their waste there and we wanted the opposite – that the waste collection will be specific only to certain house apartments. We wanted to make sure that our citizens only pay for the waste they generate, and that is why we initiated proper recording and tracking of the bins.”

Another possibility is implementing RFID tags on all bins, together with automated collection control and possibility of weighing the waste. Last year Sensoneo provided such a solution to one of the largest waste collector companies in Latvia, which decided to monitor, automate, and digitise its waste collection thanks to the installation of Watchdog on 25 collection trucks and RFID tags on 27 000 bins. Such a solution allows for identifying and recording all bin assets, simpler tracking and invoicing, and restraining use of unauthorised bins. Verification of bin emptying is done automatically, preventing any disputes between citizens and collection companies.

3. Middle East as one of top regions for implementing smart waste solutions

Countries in the Middle East region have adapted to the new trend quickly and are at the forefront of implementing smart waste technologies, combining them into unique smart city projects. Sensoneo installations in the region include the United Arab Emirates, where sensors are monitoring recycling centres since 2018, and some of our biggest recent deployments were in The Kingdom of Saudi Arabia. The country previously installed 1500 sensors to monitor general waste in the historical town Al-Ula, while in 2022 one of the largest deliveries was made to the futuristic city of NEOM. When planning new cities or neighbourhoods, it is becoming a must to include smart waste solutions as an integral part of the smart city concept.

4. Novel ways to waste monitoring

The fact that smart waste sensors can be used in various conditions was confirmed in Norway too. In cooperation with our partner Elteco, there are two unique projects ongoing.

Sensors are monitoring waste bins in several Norwegian islands, where production of waste varies with the season. As the collection is done by boat, efficient use of the boat as well as manpower is required. To optimise the waste routes, waste collectors are using data from the sensors together with weather forecasts and water temperatures.

As Håkon Fält Hardli from Elteco explains: “The islands are busiest during the summer season, and the number of visitors largely depends on the weather and water conditions. For instance, if we expect warm water and nice weather for the weekend, it is best to check and empty bins beforehand, instead of having an overflowing bin on Saturday.”

Norway also implemented underground water level monitoring in manholes which tend to overflow. According to Håkon Fält Hardli: “Installing sensors is an affordable solution that serves for two purposes: the first one is the data on how much water goes through the overflow, i. e. how big of a problem we have. Another important aspect is to detect a manhole that is getting too full and be able to drain it before it spills.”

5. Implementing deposit return schemas in more countries

Deposit return system (DRS) is the most powerful tool from the viewpoint of the circular economy, with almost immediate effect on collection rates and recycling. In the European Union, there are challenging KPIs for beverage containers collection (77 % collection goal for single-use plastic beverage bottles by 2025, increasing to 90% by 2029), and the DRS will be obligatory from 2029. According to Martin Basila, Co-Founder and CEO of Sensoneo, “such a step is necessary, since it helps the governments which are facing strong resistance from lobbying groups. We saw some countries really struggling with bringing DRS because of such opposition, and the directive solves this issue. There is a big potential in the deposit return scheme, as it can be applied to more waste streams, for example to carton or tires, but the possibilities are endless.”

Sensoneo is the first and only system integrator in two countries, Slovakia and Malta, and two more countries have given us the confidence to cooperate on their DRS system. Slovakia’s deposit return scheme was launched on 1 January 2022, already trespassing 70 % collection rate with more than 800 million bottles and cans returned to the system. DRS in Malta was launched on 14 November and more than 10 000 000 beverage containers were collected by the end of the year. Malta was the first Mediterranean country to launch a deposit return scheme, aiming to increase collection rates from 20 to 90 %.

6. Factories embracing ESG goals

Factories are setting their ESG goals, which are in some cases even stricter than those imposed by governments. Environmentally conscious businesses are striving to meet the Paris Agreement targets way before the set deadline. It is not possible to reach waste division rates without digitization, and that is where Sensoneo steps in. We are helping our customers in 20 plants and factories in Germany and Switzerland with identifying the volumes of waste in individual production phases and optimising waste collection. According to our customer in the automotive industry, “the solution brings order and efficiency to our internal waste management. Beside optimised collection routes we are receiving valuable data necessary for strategic decisions concerning our waste management policy.”