Energy from Waste : Biomethane: The solution for Europe's energy independence?

The Russian war of aggression in Ukraine made it clear that the EU is too dependent on Russian gas. Since then, the EU has been intensively searching for solutions to achieve greater energy independence. One of these is biomethane.

The upgraded version of biogas has one major advantage: It is indistinguishable from natural gas, can be used without the need for any changes in transmission and distribution infrastructure or end-user equipment, and is fully compatible for use in natural gas vehicles, as Angéla Sainz from the European Biogas Association (EBA) explains: "The deployment of biomethane to replace fossil fuels does not require the investment of additional resources to develop new infrastructure. The existing gas infrastructure is biomethane-ready. This is key to ramping up decarbonisation and providing affordable renewable energy in the form of heat, power or transport fuel for industries and households.

From biowaste to biomethane

Even though the global public focuses on plastic waste, we humans of course produce other waste streams that, if not treated correctly, cause environmental problems. Biowaste is one of them. 40 per cent of EU organic waste still ends up in landfill. In the US it's almost two-thirds. The decomposition of biowaste can contaminate local soil and water. As it breaks down it also releases methane, a greenhouse gas 20 times more powerful than carbon dioxide in terms of climate change effects. Landfills are worldwide the third-biggest human-caused source of methane, which is mostly created by organic material.

The solution to this problem is as simple as it is complicated. Simple because we just have to keep biowaste out of landfills. Complicated because the separate collection of biowaste does not come cheap and requires a lot of public education. Nevertheless, the EU and US are ramping up their biowaste game.

Apart from composting, anaerobic digestion is an ecologically and economically viable option to deal with all the organic material from plant by-products, animal manure as well as biowaste from households or industry. "These residues are placed in a biogas digester in the absence of oxygen. With the help of a range of bacteria, organic matter breaks down, releasing a blend of gases: 45–85 vol% methane (CH4) and 25–50 vol% carbon dioxide (CO2)", as Angéla Sainz explains. "The output is a renewable gas which can be used for multiple applications." For example as cooking gas, for the production of electricity as well as for heating. It can replace compressed natural gas for use in vehicles as well as displace carbon dioxide in on-site CHP plants. (see Figure 1)

To inject it in the regular gas grid, it is necessary to upgrade it to biomethane. "The upgrading removes mainly the CO2, to obtain almost 100 per cent methane, which is approximately equal to natural gas in quality and therefore injectable in gas grids," says Sainz.

Related article: Biomethane: On the road away from fossil fuels

The industry can choose from a range of upgrading technologies. According to the EBA, more than two-thirds of the biomethane plants currently active use either membrane separation, water scrubbing or chemical scrubbing, with membrane separation the most common upgrading technology. 67 per cent of the plants that went into operation in 2022 are known to use this technology. (see Figure 2)

Reducing GHG emissions

For those in favour, the advantages of biomethane production are obvious: the reduction of GHG emissions and the creation of a decentralised energy system.

"Biomethane brings significant GHG emission savings in multiple ways," Angéla Sainz explains. It prevents emissions across the whole value chain, with a three-fold emissions mitigation effect:

- Firstly, by diverting emissions that would otherwise occur naturally: organic residues are transferred to the controlled environment of biogas plants, preventing emissions from the decomposition of organic matter from entering the atmosphere.

- Secondly, by displacing fossil fuels as a source of energy.

- Thirdly, by using the digestate from the biogas production process as biofertiliser, helping to return organic carbon to the soil and reducing the need for the carbon-intensive production of mineral fertiliser.

The production of biogas and biomethane means that waste is turned into a valuable resource. "Food waste or wastewater can be recovered from our cities and used to produce renewable energy, which helps develop a local bioeconomy. In the countryside, residues from animal farming or biomass from agriculture can be optimised and converted into energy, while digestate can be used as an organic fertiliser. This creates additional business models in the farming sector, making it more cost-competitive, and promotes sustainable farming."

Related article: The Renewable Natural Gas Sector is growing fast

Decentralised energy system

The need to be more independent from Russian gas imports is also a driving force behind establishing alternative energy sources. "Biogas and biomethane can be produced at a relatively constant pace and then used to generate electricity as needed, making it possible to offer dynamic electricity production that can accommodate fluctuations in electricity demand. This promotes grid stability and provides additional options for seasonal energy storage," explains Angéla Sainz. "In addition, biomethane can be easily stored, helping balance energy supply from intermittent energy sources of renewable origin, such as solar or wind. It can also be traded and produced within Europe, ensuring the EU’s security of supply, and avoiding dependence on external providers."

But it is more than that. The focus should be on enabling and encouraging different energy sectors to work together: "This optimises the function of the energy system as a whole: it is more effective than decarbonising and making separate efficiency gains in each sector individually."

To establish a decentralised energy system dominated by renewables flexibility is key, according to the expert. In the form of flexible operations and power generation, stronger grids, more energy storage and demand response.

"In terms of future trends we see a lot of potential in the valorisation of biomethane by-products ‒ notably digestate and bioCO2 ‒ and also the expansion of innovative technologies, such as gasification or methanation, as well as novel feedstocks that can further increase biomethane production potential in the future," says Sainz.

Related article: Biowaste in the USA: Composting and Anaerobic Digestion are gaining ground

Legal framework

Rearding regulatory frameworks, there are various in the EU that have an impact on biomethane production and use since they relate not only to energy and climate change mitigation, but also to waste management and agriculture. At EU level there are the Renewable Energy Directive, the Gas Package, the Fertilising Products Regulation, the EU ETS, the CO2 standards for Heavy-Duty Vehicles to name a few. Nevertheless, regulations regarding enabling grid connection for biomethane plants are for the most part addressed at national level. In addition, there are two different gas grids in Europe. So, to get from plant to grid can be quite cumbersome.

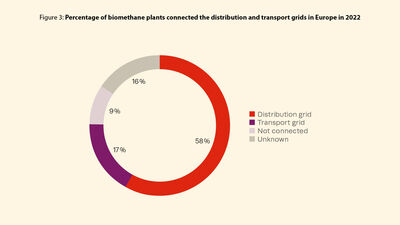

The EBA analysed regulations regarding grid connection cost sharing, gas quality, metering systems and injection fees in 28 European countries (EU+UK). According to the 2022 study, 75 per cent of biomethane plants are connected to the grid (58 per cent to distribution, 17 per cent to transmission grids). (see Figure 3)

Grid connection costs are shared between biomethane producers and grid operators in 10 out of 28 countries (EU+UK). For example, France and Germany share the connection costs for the construction of pipelines from the biomethane plant to the grid injection point between the biomethane producer and the grid operator on a percentage basis. In France, the grid operator pays 60 per cent, in Germany 75 per cent and the biomethane producer pays the remaining amount.

In countries such as the Czech Republic and Lithuania, the costs of connection to the gas network are not shared, which means that the biomethane producer bears the full cost of connection to the gas network.

Besides the cost of constructing pipelines to the injection point, some countries also charge an injection fee to cover the installation and maintenance of metering systems, grid access fees and gas quality assurance costs. This is applied in 11 of the 28 countries analysed but varies according to the country concerned.

In Sweden, for example, the feed-in tariff depends on the connection costs borne by the biomethane producer. If the biomethane producer covers all the expenses for connection to the gas grid, they do not pay any feed-in tariff. In Belgium, feed-in tariffs are approved by the regulator for TSOs and DSOs. In Latvia, an injection fee is charged by the TSO to the biomethane producer.

According to the EBA, the current status is set to change thanks to the new Hydrogen and Decarbonised Gas Package ‒ if it is implemented correctly.

Covering the EU's gas demand

The past couple of years have seen a significant increase in biomethane production. According to the EBA, Europe produced 37 TWh or 3.5 bcm of biomethane in 2021 and 4.2 bcm in 2022, representing an increase of 18 per cent. France, Italy, Denmark and the UK were the countries with the fastest growth in biomethane production in 2022. In total, biomethane was produced in 1,323 biomethane plants located across 24 European countries and 75 per cent of the plants were connected to either the transmission or the distribution grid. "Biomethane plants tend to be of larger size compared to biogas plants and in terms of feedstock use," says Angéla Sainz. "A clear trend towards agricultural residues, organic municipal solid waste, sewage sludge and industrial waste is visible." (Figure 4)

Over the same period, Europe had 17 bcm of biogas production from 19,491 plants. However biogas production has stagnated over the last decade. (Figure 5)

As part of the REPowerEU plan, the European Commission set new biomethane targets back in 2022. So by 2030, the annual EU production and use of sustainable biomethane should be raised to 35 billion cubic metres. According to the EBA, the forecast growth in biomethane production has significant potential to meet Europe's gas demand: "EU gas consumption in 2022 was 355 bcm (down from 412 bcm in 2021), according to EU gas market reports," says Sainz. "According to multiple studies assessed by the EBA, the biomethane production potential by 2050 ranges between 95 and 167 bcm. This represents 27 to 47 per cent of EU gas consumption in 2022. Assuming a reduced total gas demand in 2050 of 271 bcm, it is estimated that biomethane will be able to cover 35 to 62 per cent of the European gas requirement by that date."

Realising this potential will require streamlining processes and regulations to smooth grid access and facilitate the widespread substitution of natural gas in Europe's energy infrastructure. The European Commission has realised that in order to be able to achieve the targets set in the REPowerEU plan, there is a lot of work to be done. That's why the Biomethane Industrial Partnership (BIP) was established. The BIP acts as a strategic platform to facilitate dialogue between private and public stakeholders in the biomethane sector. Its main objective is to promote collaboration between all the key players in order to support the achievement of the target of 35 billion cubic metres of sustainable biomethane production and use per year by 2030, and to create the conditions for a further increase in its potential towards 2050.